Blockchain technology is considered to be one of the top emerging innovations that is predicted to bring transformational change across the globe. As per the World Economic Forum report, 10% of global GDP will rest on the blockchain by 2027. According to a study by the Frankfurt School Blockchain Center (FSBC) the market size of tokenized assets in Europe will grow to $1.5 trillion USD within the next 3 years.

Blockchain technology has indeed given us a new dimension on the manner in which value can be exchanged. Although the innovation gained recognition through bitcoin, its potential applications will fundamentally change the way we interact with real-world assets. Through a concept known as tokenization, with its foundation laid on blockchain technology, it aims to disrupt industries – from finance to real estate.

What Is Tokenization?

Tokenization refers to the process of creation of digital tokens on a blockchain platform, that grants certain ownership or other rights to physical, digital or even financial assets to token holders. Asset tokenization enables easier exchange for tangible and intangible assets through digital tokens on a global platform empowered by blockchain technology. The assets that can be represented by a token can range from financial instruments like debts, bonds, stocks and securities to legal rights, copyrights, or physical assets like real estate property, cars and art.

The digital tokens that are created and managed on a blockchain network often referred to as security tokens. The use cases where a token represents ownership rights in relation to other assets oftentimes fall under securities regulations in many countries, thought it is not necessarily the only scenario, but for the purpose of this article, let’s focus on security tokens, since they become more and more common Each security token is backed by or represent the legal and ownership rights to the underlying asset and hence it carries inherent value of that asset. The concept of tokenizing or digitizing assets has existed for a long time, but there was a lack of appropriate tools to manage it. The innovation of blockchain has converted this theoretical subject into an on-the-ground reality.

The digital tokens that are created and managed on a blockchain network often referred to as security tokens. The use cases where a token represents ownership rights in relation to other assets oftentimes fall under securities regulations in many countries, thought it is not necessarily the only scenario, but for the purpose of this article, let’s focus on security tokens, since they become more and more common Each security token is backed by or represent the legal and ownership rights to the underlying asset and hence it carries inherent value of that asset. The concept of tokenizing or digitizing assets has existed for a long time, but there was a lack of appropriate tools to manage it. The innovation of blockchain has converted this theoretical subject into an on-the-ground reality.

The potential implication of tokenization has created a plethora of applications in multiple industries. Moreover, blockchain-enabled tokenization is predicted to have a major impact across the world in the upcoming years. An investigative study, based upon analysis of more than 100 Security Token Offerings reveals that the volume of STO’s increased from $65 million in 2017 to $453 million in 2019. Another research states that the global tokenization industry is predicted to reach $2.1 billion by the year 2025 by a compound growth of 21%.

What Are Tokenized Securities?

Tokenization essentially refers to the digitization of the legal rights or ownership rights to an asset on a blockchain network. If we follow similar logic, a tokenized security would be the process of establishing financial rights in a security through the issuance of tokens on a blockchain platform. Tokenized securities on a blockchain may potentially represent a share or financial rights of any individual in any particular asset, the rights to receive certain benefits from the asset, or the rights to receive the proceeds if or when the asset is sold. Stocks, bonds, equities, or investor shares, contractual rights in commercial contracts, insurance premiums and many other assets can be tokenized. One of the main benefits of tokenized securities is that they enable access to assets that have been typically illiquid.

While the concept of tokenized securities has pre-existed, blockchain has given a digital makeover to the structure. Digital assets, representing financial rights to any asset, can be traded on a transparent platform with a decentralized ledger recording each aspect of the transaction.

Although crypto is still considered to be fairly new, it has encapsulated different categories and their subsequent advantages within its infrastructure. Crypto securities, one of the categories, would open an array of possibilities through rule-based financial contracts- managed on the blockchain, that go way beyond the capabilities of traditional securities. These tokenized securities would provide financial value to each and every portion of an asset through the use of blockchain’s infrastructure. This would further enable an ecosystem for ‘Tokenization of Everything’- from a portion of a land piece to a company’s equity stock.

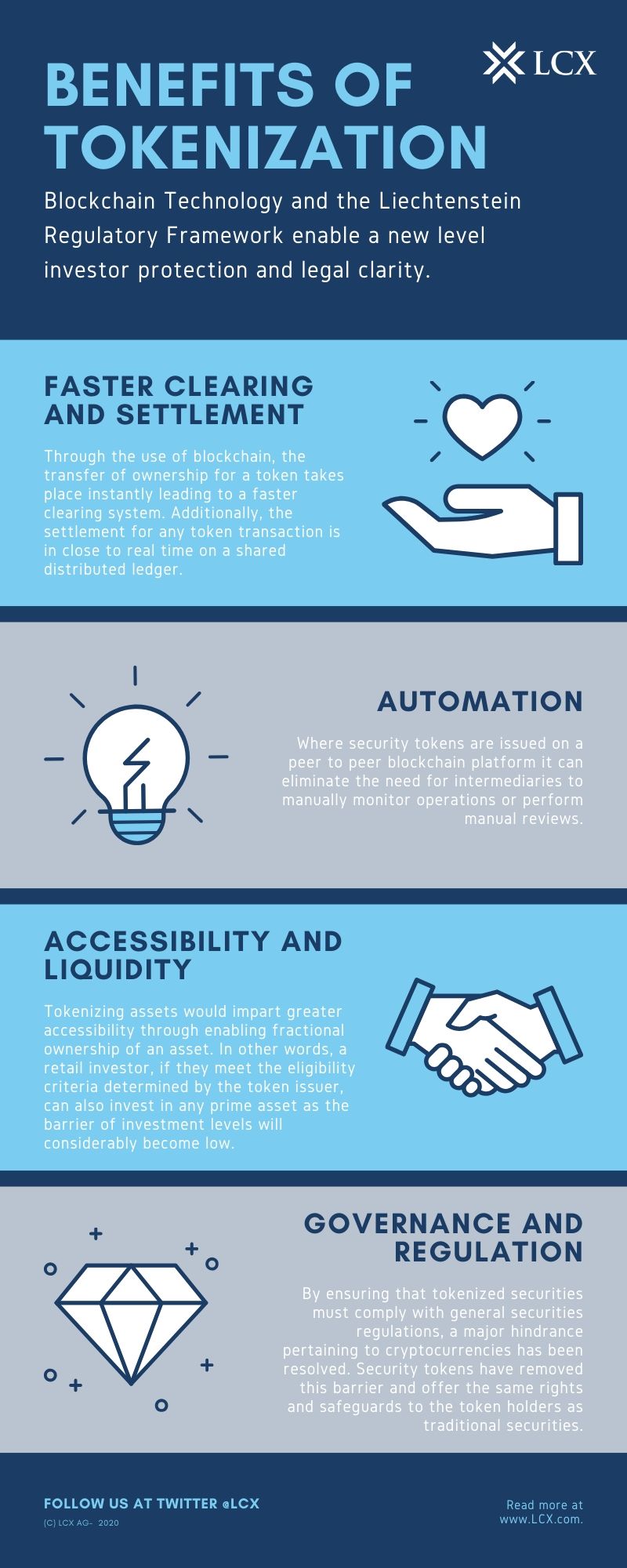

Benefits of Tokenized Assets and Regulated Digital Assets

The art of tokenization in combination with the blockchain platform, smart contracts, and a regulated environment has multiple advantages.

Faster Clearing and Settlement

Through the use of blockchain, the transfer of ownership for a token takes place instantly leading to a faster clearing system. Additionally, the settlement for any token transaction is in close to real time on a shared distributed ledger. Faster clearing and settlement of tokenized securities can potentially have huge implications in the financial markets, providing easier price discovery and more transparent transactional track record.

Automation

Where security tokens are issued on a peer to peer blockchain platform it can eliminate the need for intermediaries to manually monitor operations or perform manual reviews.

Accessibility and Liquidity

Tokenizing assets would impart greater accessibility through enabling fractional ownership of an asset. In other words, a retail investor, if they meet the eligibility criteria determined by the token issuer, can also invest in any prime asset as the barrier of investment levels will considerably become low. Security tokens can further be traded on a global platform that operates round the clock in real time. Fractional ownership, low capital requirements, and an international network ensure the flow of liquidity with tokenizing.

Governance and Regulation

By ensuring that tokenized securities must comply with general securities regulations, a major hindrance pertaining to cryptocurrencies has been resolved. Security tokens have removed this barrier and offer the same rights and safeguards to the token holders as traditional securities. This promotes an atmosphere of trust and customer confidence, especially for the first-time buyers of the tokenizing financial assets. Furthermore, blockchain technology also ensures immutability and transparency that are key aspects of governance in trading tokenized securities.

Security Token Offerings (STO)

After ICO’s, a new and regulated way of investments in blockchain projects emerged namely Security Token Offerings or STO’s. Security Token Offerings is the instrument that enables tokenization of an asset by creating a token that would generally meet the definition of a security. This model of raising funds for blockchain projects quickly became popular owing to the multiple advantages of tokenizing assets through blockchain technology. Additionally, STO’s have a significantly higher degree of legal compliance aspect to it.

The first STO’s were launched in the year 2017. This report by PWC suggests that the volume of STO’s rose to $442 million in funding by the end of 2018. According to the data analysis report in 2019, STO’s saw a 130% increase from Q4 2018 to Q1 2019. Another comprehensive study reveals that the market of security tokens of the European Union is likely to exceed the global market of cryptocurrencies in 2022.

Furthermore, with the mainstream adoption of cryptocurrencies and blockchain technology the interest in STO’s is likely to boost. In addition to this, regulations pertaining to the status of cryptocurrencies across the world have eased or become legally regulated.

Legal Certainty due to the Blockchain Laws in Liechtenstein

We could explain the key benefits of the Liechtenstein Laws, the container model and why it matters in one paragraph.

LCX AG is established in Liechtenstein and we have wholeheartedly welcomed new Blockchain Act that came into force in 2020, because it provides essential clarity for the blockchain industry in terms of which services are regulated, which entities need to secure a license to operate, and what the licensing conditions are. At the same time, the Blockchain Act provided substantial benefits for the customers and users of the blockchain service, by integrating all potential rights of the token holders into existing national legislation, such as contractual law, securities law, bankruptcy law, consumer and investor protection, etc.

The Liechtenstein Blockchain Act essentially views the token as a container, in a sense that this tokenized container can represent certain commercial, legal, economic, financial, ownership or other rights of the token holder, and irrespective of the format (physical, digital, paper-based or tokenized) all these legal rights are equally protected and guaranteed in Liechtenstein.

Market Size of Tokenization

Research, forecast, and studies suggest that tokenization of regulated digital assets would have a huge impact on a number of different industries. Let’s take a look at some of the key statistics based on the studies performed by leading institutions.

Research by Deloitte suggests that the art of tokenization will possibly disrupt many industries, in particular the financial industry, and unlock trillions of euros in value. As per the Bank for International Settlements (BIS) report of 2020, tokenization of assets would play a major role in streamlining the settlement cycle by cutting out intermediaries and an efficient flow of liquidity.

The segment that is expected to register maximum growth through tokenization is the BFSI (banking, financial services, and insurance), as per research conducted on tokenization market share. Geographical analysis from the same study suggests that North America is likely to lead the market of tokenization followed by Asia Pacific and Europe between the period 2019-2027.

In Europe, following BaFin licensing for crypto custodians, a study suggests that the market of tokenized assets is expected to reach $1.5 trillion by 2024 in the European Union.

Tokenization of Everything

Key statistics clearly suggest that the future is going to be completely digitized and empowered by blockchain. From owning a stake in your favourite sports team to gaining fractional ownership of an apartment in New York – the possibilities may be endless!

Another noteworthy figure that discloses a wider picture is – there is $256 trillion worth of real-world assets today. Most of these assets are illiquid. Moreover, the current methods of buying and selling an asset have become outdated. Tokenization represents an innovative approach by converting physical assets into their digital counterparts. Additionally, the use of smart contracts ensures a clear and concise method towards ownership of security tokens and thereby the piece of asset. Digital assets will be securitized in the form of stocks, bonds, debts, equities or investment funds that would further represent an investor’s stake in any real-world asset.

Tokenized securities also enable benefits of fractional ownership, efficient processing, cheaper operations, greater transparency, and higher liquidity. Furthermore, tokenization will include a stream of retail investors by lowering barriers of capital that still persist with traditional securities.

The blockchain infrastructure also enables the development of marketplaces for buying, selling, and trading digital assets such that each transaction is recorded on a transparent and immutable ledger.

Monty C. M. Metzger, CEO of LCX states: “Everything that can be tokenized, will be tokenized. Since the start of LCX, we’ve built advanced technology and legal expertise to enable a new financial infrastructure for regulated and compliant digital assets.”

Such advantages of tokenized securities, current estimates and projections reveal that the future is all about tokenization.