The realm of cryptocurrency trading is renowned for its volatility and the challenge of predicting its movements. Consequently, traders have employed trading indicators since the inception of this practice to enhance the accuracy of their forecasts about the future of crypto assets.

To facilitate ease of use for traders, the LCX Exchange offers integrated TradingView charts that enable the application of diverse technical indicators while trading on the exchange. It is crucial to have a fundamental comprehension of cryptometrics to utilize these indicators optimally.

For an in-depth understanding of common cryptometrics, refer to Most Common Crypto Metrics. The primary function of trading indicators is to determine the market’s direction utilizing graphs and mathematical formulas. Crypto traders and investors analyze market conditions using an indicator and a trading chart. The evaluation of past market movements is vital to forecasting future price trends and patterns, which trading indicators accomplish.

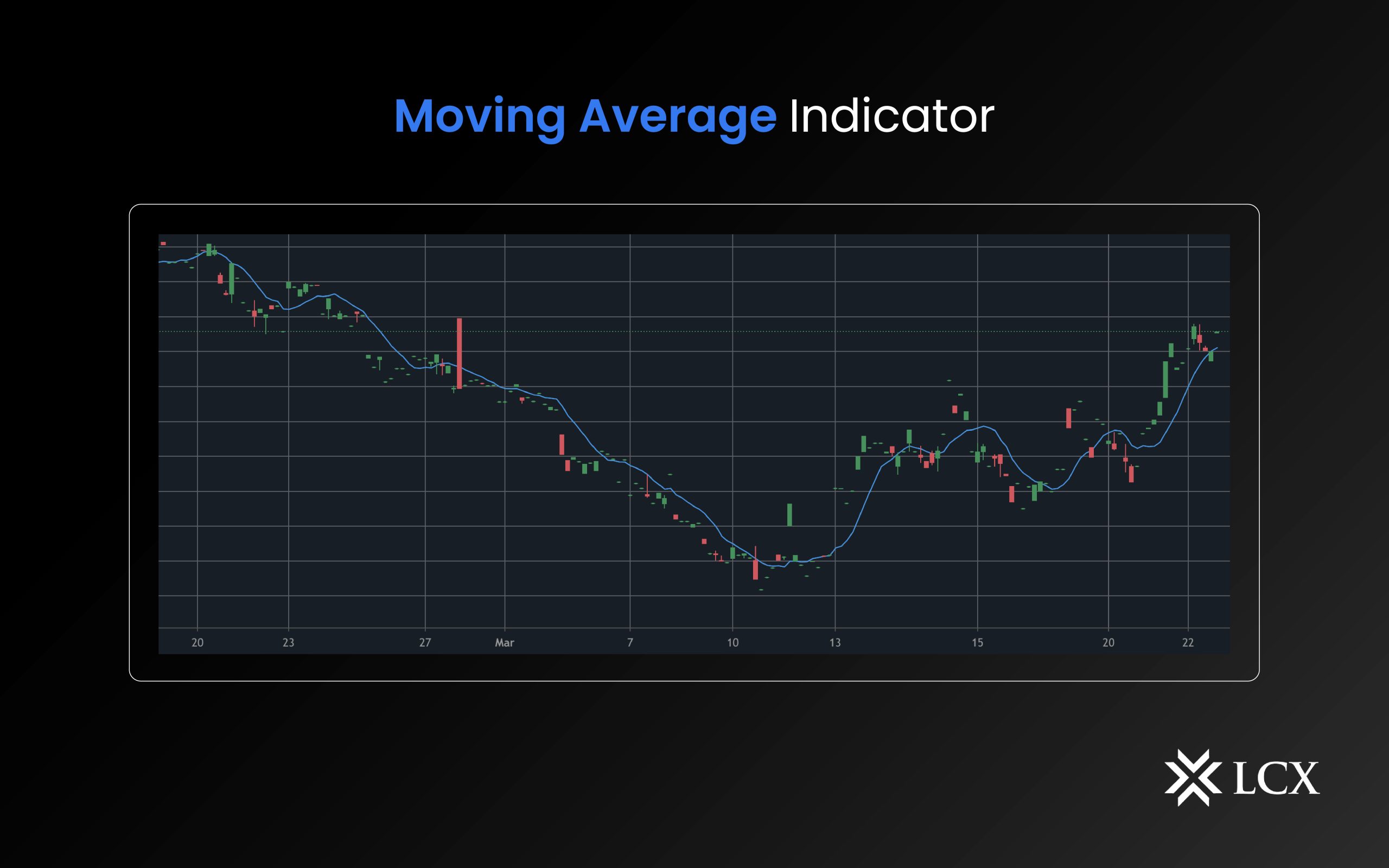

What is the Moving Average Indicator?

The moving average is a technical indicator that shows the average price of a specified number of recent candles. It is a very effective indicator, as it helps traders find the trend without an information overflow. The basic concept is to discover what average traders are doing in the market. They smooth out the price action by filtering out the “noise,” which is an expression used to refer to random short-term fluctuations in price. In terms of indicator type, the moving average is a lagging indicator because it is based on past prices.

In the world of cryptocurrency, the moving average can be especially useful in identifying trends, determining potential entry and exit points, and making more informed trading decisions. There are several types of MA indicators, including the simple moving average (SMA), the exponential moving average (EMA), and the weighted moving average (WMA). Each type is calculated differently and can offer unique insights into the price action of a cryptocurrency.

Why Do Crypto Traders Use This Average Indicator?

One of the primary benefits of using the moving average in cryptocurrency trading is its ability to smooth out price action and highlight underlying trends. By averaging out the noise of day-to-day price fluctuations, the moving average can help traders focus on the big picture and make more informed decisions. In addition to identifying trends, this indicator can also be used to identify potential support and resistance levels. When the price of a cryptocurrency approaches a moving average, it can act as a barrier that either supports the price (if the trend is upwards) or resists further gains (if the trend is downward). Traders can use the moving average in a variety of ways, including as a standalone indicator or in conjunction with other technical analysis tools. For example, traders may use multiple moving averages on the same chart to get a clearer picture of the trend, or they may use the moving average indicator in combination with other indicators such as Bollinger Bands or the Relative Strength Index (RSI).

In Conclusion

In conclusion, the moving average indicator is a valuable technical indicator that can help traders and investors analyze the price action of a cryptocurrency and make more informed decisions. Whether used as standalone indicators or in combination with other analysis tools, the moving average can be an important part of a trader’s toolkit.