Decentralized Exchanges (DEX) are algorithms on a blockchain that facilitate the automatic and intermediary-free trading of crypto assets between users. Uniswap is the largest Ethereum DEX with a market share of over 50 percent and $5.95 billion in TVL (Total Value Locked). Instead of order books, DEXs rely on liquidity pools to provide liquidity. Liquidity pools or liquidity provider tokens, are investor-sourced pools of crypto assets that enable users to buy, trade, borrow, lend, and swap tokens. DEXs clear their buy and sell orders with assets from liquidity pools. These pools facilitate the conversion of one asset into another without causing a significant price change.

What Are Liquidity Provider Tokens?

LP Tokens, or Liquidity Provider Tokens, are the tokens issued to the liquidity providers on a decentralized exchange (DEX) that runs on an automated market maker (AMM) protocol. It functions as a reward mechanism that helps facilitate transactions between various types of currencies. Decentralized exchanges rely on Liquidity Providers to ensure that the cryptocurrency trading market is active. When a liquidity provider deposits assets into the “liquidity pool,” they are rewarded with Liquidity Provider tokens. These tokens represent an individual’s proportional share of the fees earned by the liquidity pool. They serve as a receipt for the liquidity provider, who will use them to reclaim their initial investment and accrued interest.

LP tokens have additional applications beyond releasing the provided liquidity. They permit the liquidity provider to gain access to crypto loans, convey ownership of staked liquidity, and earn compound interest through yield farming. Compound interest refers to interest earned on the initial deposit amount. For instance, 10% annual interest on $1,000 is $100, while compound interest calculated on $1,100 in the second year is $110, totaling $110. Decentralized exchanges (DEXs) and automated market makers (AMMs) grant their users complete custody of their locked assets via LP tokens, and the majority of DEXs and AMMs permit users to withdraw them at any time after redeeming the accrued interest.

What Are Liquidity Providers?

In decentralized finance (DeFi), the majority of tokens have small market caps, low liquidity, and limited availability, making it difficult to locate a counterpart to match an order. Liquidity facilitates the purchase and sale of an asset on the market without affecting price fluctuations. Highly liquid assets have many buyers and vendors on the market, allowing trades to be executed quickly and at a low cost. Low-liquidity assets, on the other hand, have fewer buyers and sellers, making it more difficult to implement trades, which can result in price slippage or high transaction costs.

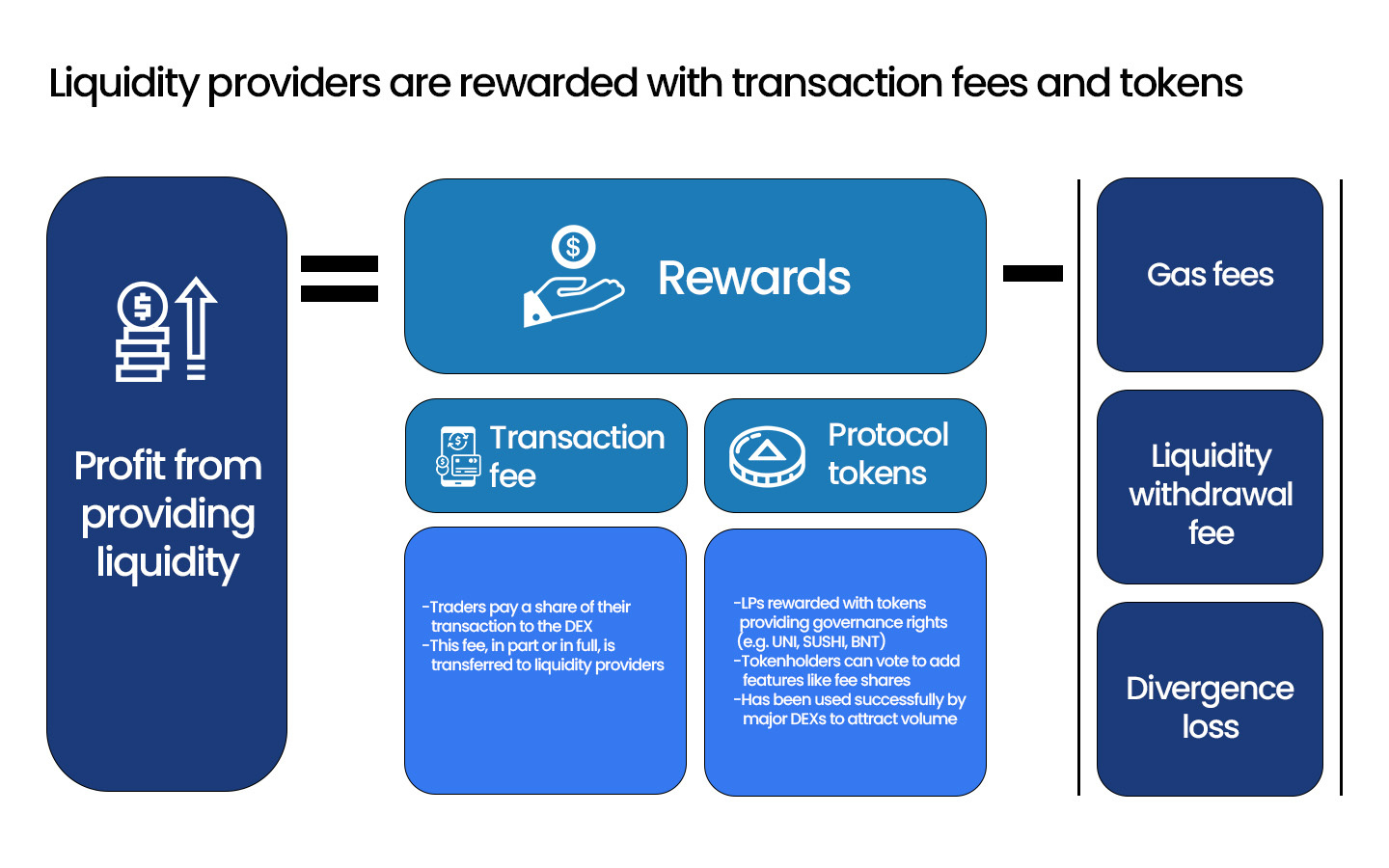

In order to earn transaction fees, liquidity providers use a strategy known as liquidity mining or market-making to stake their currencies on decentralized exchanges. These transaction fees are frequently expressed as interest rates, which fluctuate based on a number of variables at the time the transaction is finalized, such as the amount of available liquidity and the number of active transactions in the liquidity pool. Liquidity providers deposit two token pairs into a liquidity pool. Once deposited, they can swap between their tokens and charge a small fee to users who use their tokens to swap. For contributing assets such as Ether (ETH) to the pool, liquidity providers receive LP tokens representing their pool share, which can be redeemed for any transaction-related interest. LP tokens are always under the control of their providers, who determine when and where to withdraw their share of the pool.

What Are Automated Market Makers (AMM)?

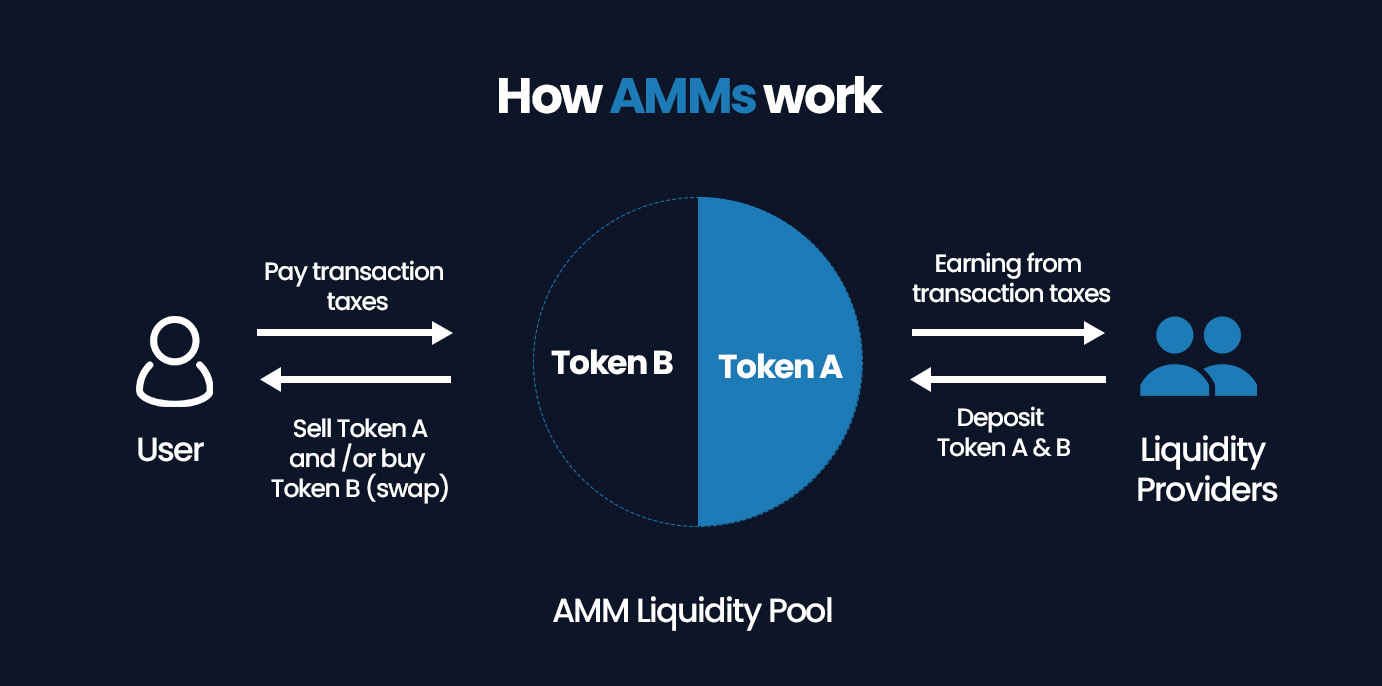

The majority of DEXs use Automated Market Makers (AMM) to facilitate trades. AMMs are the protocols or trading mechanisms that do away with middlemen and order books. It provides autonomy and utilizes smart contracts to determine asset prices. There is an individual liquidity pool for each asset pair, and anyone can provide liquidity to these pools. There are predetermined mathematical equations for balancing liquidity pools and preventing drastic price fluctuations in assets. Each liquidity pool rebalances to maintain a 50/50 split of cryptocurrency assets, which determines the asset’s price.

How Do LP Tokens Work?

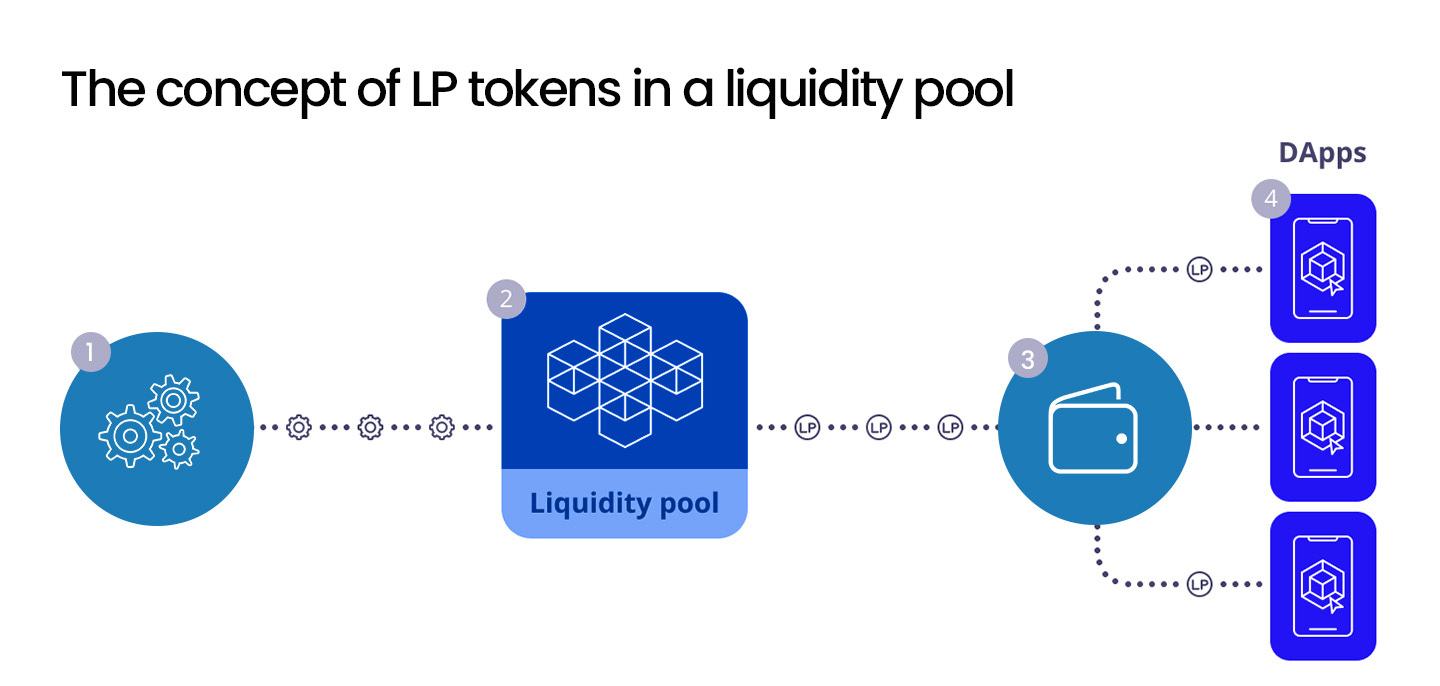

The liquidity mining protocol rewards LPs with Liquidity Provider Tokens for supplying liquidity. It represents the proportion of the pool that a liquidity provider owns. LPs have complete control over their tokens and can redeem their crypto assets at any time using LP tokens. LP tokens serve as a balancing mechanism and provide investors with a sense of security for the assets deposited in the pool. According to the terms of the smart contract (liquidity pool), it is feasible to transfer ownership of LP tokens. LP tokens may also be used as loan collateral.

Within DeFi, Liquidity Provider tokens address the issue of locked cryptocurrency liquidity. In other words, prior to the introduction of LP tokens, crypto assets were sealed or staked for specific mechanisms (including governance) and were inaccessible. This resulted in diminished liquidity and activity in the cryptocurrency ecosystem. With the adoption of LP tokens, it is possible to create larger pools of liquidity for assets contributed by users, enhance the liquidity of the market, and financially incentivize LPs in exchange for the service they provide through the issuance of LP Tokens.

The functioning of the token is simple and straightforward; once crypto users have decided to invest in LP tokens, they can select a liquidity pool and begin depositing crypto assets in exchange for LP tokens. If a user contributes 10% of the pool’s liquidity, they will receive 10% of the pool’s LP tokens. The tokens will be added to the liquidity wallet and can be withdrawn at any time, along with any accrued interest.

As with any other crypto asset, LP tokens should always be kept secure, as losing them would result in investors losing their share of the pool. However, LP tokens can be freely transferred between various decentralized applications (DApps), and only withdrawing from the pool results in the loss of the right to a liquidity pool share.

Conclusion

In DeFi, LP tokens serve a crucial role. In addition to determining your share of the liquidity pool, they can be used for yield farming, collateral, and transfer value. LP tokens are an enticing method to generate passive income from your crypto assets, despite the risks associated with them. Overall, the DeFi space is in a constant state of evolution; consequently, use cases for LP tokens are perpetually being created. Diversifying your portfolio as an LP token holder should not be an afterthought. Depending on your risk tolerance, you can determine how to maximize the returns on your LP tokens.