The term ‘crypto-asset’ or ‘digital asset’ has far moved beyond the horizons of bitcoin. As defined by the Financial Stability Board (FSB), a crypto asset refers to a private asset that is dependent upon cryptography and procures its inherent value from Distributed Ledger Technology (DLT) like blockchain.

Cryptography and blockchain technology enables an asset to be converted into its digital representation. The digital representative, also known as a security token, can further be digitally transferred over a DLT network. The application of tokenizing an asset over a blockchain architecture has essentially encapsulated various sectors from finance to the real estate industry.

The Wider Perspectives of Security Tokens

The blockchain innovation gave a new meaning to the concept of digital assets. Moreover, the decentralized ledger facilitates the exchange of value in the form of security tokens over a global network. The wider perspective of benefits including increased liquidity, inclusive development, greater access, and new business models through security tokens will revolutionize a number of industries.

According to this article source, nearly $544 trillion worth of assets can be tokenized worldwide. Furthermore, the industry that is expected to witness the maximum growth is the BFSI (Banking, Financial Services, and Insurance). Another research by Deloitte also suggests that while tokenization of assets will impact a wide range of industries, the financial sector is likely to get affected the most.

It is certain the digital assets are emerging as an innovative tool for investments that will benefit all the participants in an ecosystem. This includes issuers, investors, and regulators that can leverage transparency and efficiency in a tokenized infrastructure.

However, as the market of tokenized digital assets is growing at a global scale, there needs to be an identifier for a standardized reference. A uniform framework needs to be established that incorporates data attributes in a consistent pattern. Similar to the tools available for the traditional financial market, there needs to be a reliable system wherein each participant or an entity is given a digital identifier that enables investors across the globe to make trading decisions.

What Is a Legal Entity Identifier (LEI)?

After the global financial crisis of 2008, the need to identify legal entities at an international scale became all the more necessary. The need for a standardized identifier that provides a distinct identity to entities became crucial.

Legal Entity Identifier, denoted as LEI, is a 20-digit alphanumerical code that gives a unique identity to entities involved in financial transactions. Leveraging it in global markets, LEI further enables an ecosystem that is uniform, efficient, faster and reduces infrastructure costs.

According to a report by McKinsey, the wider use of Legal Entity Identifiers (LEIs) across the global banking sector could save the industry $2-4 billion USD annually. Moreover, LEIs facilitate streamlining a process and further assist with reduced transaction time, increased customer satisfaction, and reduction in operational costs for the entity.

Incorporating an LEI system for an entity also helps eliminate the pain-points of financial institutions. The usage of LEIs facilitates increased transparency, improved system connectivity, better compliance, and credit risk for financial entities. Furthermore, LEIs enable recognition at an international scale eliminating the operational hassles of cross border transactions.

Benefits of Legal Entity Identifier for the Blockchain Industry

The inherent function and nature of the Legal Entity Identifier (LEI) is in itself ‘digital’. However, under the current infrastructure, the LEI data is stored within various sources. This, in turn, becomes a matter of conflict with separate entities that possess different sets of information. Moreover, our current system for storing and managing LEIs faces a number of issues including fragmented data, loopholes for fraudulent activities, absence of transparency, and threat to the security of data.

Blockchain technology is essentially a decentralized ledger that records data or transactions in an immutable and transparent manner. The ledger is used to record each event pertaining to transaction, entity, data, document, or token and permanently store it on its database.

The benefits of the blockchain ledger can also be leveraged for creating a resilient Legal Entity Identifier (LEI) system. Here are some of the key advantages of implementing a decentralized system for a standardized identification framework.

- Decentralized- The digital identifier is essentially generated in a decentralized ecosystem so as to impart trust and value to the data among the unknown parties. Blockchain facilitates the ideal instrument for a decentralized environment wherein any two unknown parties can directly transact with each other without the need for an intermediary.

- Non-Repudiation- The LEI needs to be non-repudiation such that no entity or individual can question its identification and authentication. The blockchain ledger serves as the ultimate truth that is agreed upon by all the participants of the ecosystem. The data is stored in an immutable manner so that no one can tamper the information on the ledger.

- Transparency- Data pertaining to LEI is stored transparently such that the approved regulators and stakeholders can access the information. Moreover, the data is stored in a distributed and shared infrastructure with all the relevant parties holding the same truth of the LEI data.

- Authenticity- With one shared database of digital identifiers that is the ‘ultimate truth’, blockchain helps incorporate authenticity of the information. Further, it also brings a degree of accountability to the stakeholders, regulators, and entities involved.

- Resilience- The database of digital identifiers need to be stored and managed on resilient and robust infrastructure. Cryptography enables a system of blockchain architecture that is resilient towards external threats.

In addition to the above advantages, smart contracts would further help in automating activities pertaining to LEIs like digital assets. The identifier will be treated as a single unit of data for the smart contract. Each activity pertaining to the specific LEI will be monitored by a smart contract and recorded on a blockchain. This ensures that all the data of LEI and its representation are permanently stored on a decentralized ledger- which acts as the single source of truth. As new events are added to the LEI, they subsequently get recorded on the ledger.

Integrating LEI Within a Blockchain Ecosystem

LEI is a global indicator that is not restrictive to borders. Instead, the Legal Entity Identifier is the ultimate source of assurance between any participants. There are two aspects to incorporating LEI with blockchain and digital assets.

The first is issuing LEIs on a blockchain-enabled platform. This entails LEIs all the benefits discussed above. Incorporating it on the blockchain ensures the ideal infrastructure environment for an LEI to function effectively. The blockchain ledger tracks each change pertaining to the specific LEI and further stores it in a decentralized environment. Moreover, managing it on a DLT system enables additional benefits of greater transparency and increased security to the LEI database.

The second scenario is using an LEI system to track financial instruments like digital assets. N other words, leveraging LEI to track digital assets like security tokens. The advantage of integrating a legal identification system for any entity that further manages digital assets adds an extra layer of regulatory compliance. This further entails a greater degree of trust and security among the participants or users of the financial entity as well as the instrument.

International Securities Identification Number for Security Token Offerings

Since digital assets are tokens that will be traded, exchanged, and purchased on a global secondary platform; incorporating a digital identity structure to financial entities involved in this process has become crucial. Furthermore, it gives a standardized framework that enables accuracy and reliability in a global ecosystem for all the market participants.

Additionally, measures for taskforce and research for a trusted system of ISO identifiers, specifically for digital assets has already been implemented in place. Within the International Organisation of Standardisation (ISO), a task force has already set up to evaluate the digital identifiers need pertaining to digital tokens. The Association of National Numbering Agencies (ANNA) has formed a task force to research on how standard International Securities Identification Numbers (ISINs) could be used to identify assets like security tokens.

ISIN number is a 12-digit code, that facilitates clearing and settlement of securities and payment processing during the issue of a specific security. For STO’s, a standard framework of ISIN will further enable international standards for digital assets as well as its issuing mechanism of Security Token Offerings (STO). With a universally recognized digital identifier, ISIN would further help cater to the demands of exchanges, regulators, service providers, and custodians in a consistent manner. Moreover, standardized attributes will help create a singular environment for digital assets like security tokens.

Furthermore, such a regulatory framework will facilitate a resilient environmental system for fundraising mechanisms like STO’s. It will help build trust within the participants of the STO ecosystem. Additionally, the legal structure will lessen the loopholes for illicit or corrupt activities in the cryptocurrency market.

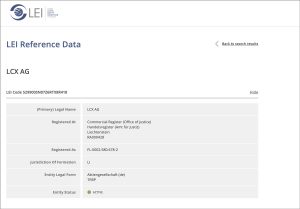

LCX utilizes Identifiers for Digital Assets

LCX, a blockchain-based platform, offers access to digital assets in a regulated and secure environment. LCX aims to provide industry-grade infrastructure for digital finance within a legally compliant ecosystem. The Liechtenstein Cryptoassets Exchange platform leverages advanced technology and innovative tools to provide an infrastructure for issuing, storing, and trading digital assets. By offering leading crypto-asset services, LCX enables traditional players and new participants to leverage opportunities in the crypto asset marketplace.

LCX, a blockchain-based platform, offers access to digital assets in a regulated and secure environment. LCX aims to provide industry-grade infrastructure for digital finance within a legally compliant ecosystem. The Liechtenstein Cryptoassets Exchange platform leverages advanced technology and innovative tools to provide an infrastructure for issuing, storing, and trading digital assets. By offering leading crypto-asset services, LCX enables traditional players and new participants to leverage opportunities in the crypto asset marketplace.

After successfully launching nearly dozens of products, LCX has also received its own LEI and ITIN number. LCX now plans on using the LEI, ITIN and ISIN numbers to further assign identifiers to digital assets in the financial sector. The LEI indicator for digital assets would enable LCX to ensure a greater degree of customer satisfaction for its users. Moreover, a unique identifier helps in streamlining various processes to provide efficient and faster execution for settlement.

The usage of LEI will also help remove pain points with digital asset transfer and management. Unique credentials to digital assets will further allow a frictionless method to track digital tokens and hence enhance transparency in the process. Additionally, the digital identifier also minimizes hassles pertaining to KYC and due diligence. The LEI acts as a significant tool that reduces operational costs along with lowering settlement times. Compliance driven adoption with LEI also enables increased trust and security for products available at LCX.

Overall, the LEI for digital assets will enable customer lifecycle management to provide optimum services to the user of LCX.